MaxProtect Insurance AI Agent

Personalized Protection and Secure Decisions

Introducing MaxProtect, our AI insurance agent with personality and specialization in the insurance sector, designed to automate quoting, simplify policy comparison and streamline claims management, allowing you to offer a superior experience to your customers.

Implementation of your AI Insurance Agent

We create your customized digital workforce

Our AI Agent implementation services are designed for insurance brokers, agencies, insurers, and operations managers seeking a sustainable competitive advantage.

Forget generic bots. At Automaxia, we design, train, and deploy intelligent avatars like MaxProtect, which seamlessly integrate with your team to generate measurable results.

Do your teams spend more time on manual processes than on advising and serving your customers ?

Identify the Obstacles that Limit Your Efficiency and the Policyholder Experience that MaxProtect Can Eliminate

Slow and complex quoting processes that cause prospects to abandon their projects.

Customers confused by policies with complex terminology and difficult to compare with each other.

Opaque, slow, and frustrating claims management, creating a bad experience at the most critical moment.

Lack of personalization in the insurance offer, missing cross-selling and up-selling opportunities.

Overburdened support teams answering frequently asked questions about coverage and claim statuses.

Data that Proves Why an AI Insurance Agent Is the Solution

Figures that Reflect the Potential of an AI-Powered Insurance Operation

Improves Customer Experience and Satisfaction

- 80% of insurance customers say that an easy and fast experience is a key factor when choosing or renewing their provider.

- How MaxProtect Achieves It: It offers instant quotes, clear comparisons, and 24/7 access to claim status, transforming points of friction into positive experiences that foster loyalty.

Increase Efficiency and Reduce Operating Costs

- 71% of consumers expect personalized experiences from companies.

- How MaxMarket Does It : MaxMarket uses AI to segment audiences and personalize messages on a scale impossible to achieve manually. By delivering relevant content to each user, it increases engagement and conversion rates for your campaigns.

Meet your new strategic ally to fill your schedule with qualified visits

MaxProtect is Our AI Insurance Agent Designed for Clarity and Trust

How to Activate Your AI Insurance Agent in 4 Steps

A Collaborative Methodology for Rapid Deployment and Successful Adoption

Analysis and Strategy:

We understand your processes and policy types to design the personality and functions of your agent.

Design and Training:

We created MaxProtect and trained it with your specific data (policy conditions, claims processes) so that it can master your portfolio.

Integration and Testing:

We connect your agent to your systems (CRM, insurance management software, Web) and validate their performance.

Launch and Optimization:

We activated MaxProtect and monitored its performance to ensure continuous improvement.

We trained MaxProtect to be a Specialist in Different Branches of Insurance

MaxProtect Understands the Specific Needs of Each Type of Protection

Life and Health Insurance:

MaxProtect helps compare plans, explains medical coverage, and guides you through the application process.

Auto and Home Insurance:

Generates quick quotes, assists in opening claims for accidents or losses, and answers questions about the policy.

Business Insurance (SMEs):

She advises on liability insurance policies, asset insurance, and employee coverage.

Travel Insurance:

And more!

Why choose Automaxia for your AI Agent Implementation ?

Our fusion of creativity, industry specialization, and results-oriented focus makes us unique.

Agents with Personality:

We create agents that not only work, but also connect with your agency’s image and your clients.

In-depth Industrial Specialization:

We don’t use a generic model; we train each agent for the challenges of the real estate sector.

ROI-Focused Approach:

Each agent is designed with a clear objective: to increase qualified visits and reduce sales time.

Integration and Scalability:

Our solutions connect with your tools and grow at the pace of your property portfolio.

Trust Based on Experience and Specialized AI Focus for Sales

An expert team dedicated exclusively to the successful implementation of AI

10 Reasons to Choose Us as Your AI Agency

Proven AI use cases in over 10 key sectors

Aspect

- Measurable Results

- Support

- Personalization

- Frictionless Implementation

- Human Language in AI

- Total Transparency

- Model and Market Adaptability

- Practical Training

- Integration with Your Tools

- Legal and Ethical Compliance

Automaxia AI Agency

- Clear KPIs and fast ROI60

- Understanding, mentorship, and support

- Solutions tailored to your business

- Fast and without interruptions

- Clear and empathetic communication

- Clear pricing and simple contracts

- Solutions adapted to your audience

- Team training

- CRM, ERP, e-commerce, and more

- Secure AI aligned with regulations

Large Consulting Firms

- Unclear goals

- Only during the contract

- Generic models

- Bureaucratic processes

- Technical jargon only

- Complex quotes and hidden fees

- Partial adaptation

- Documentation only

- Some can integrate

- Medium clarity on policies

AI Freelancers

- Difficult to measure impact

- Limited

- Varies by freelancer6

- Can be delayed

- Depends on the freelancer

- Lack of process knowledge

- They use generic models, no adaptation

- They implement and leave

- Uncertain scalability

- Little guarantee of legal compliance

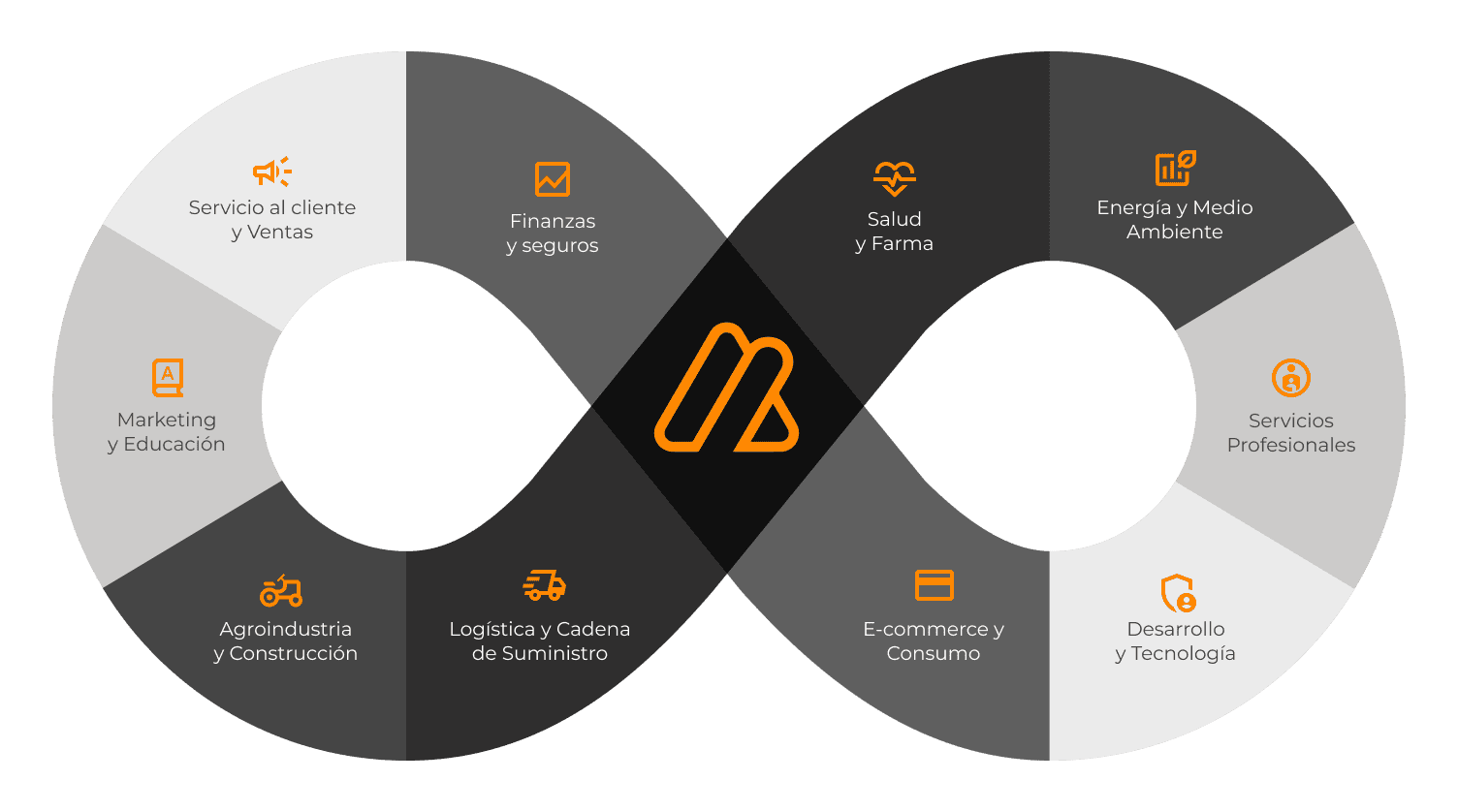

Artificial Intelligence Company with Experience in Various Industries

Proven AI Use Cases in More Than 10 Key Sectors

Results You Will Get When You Activate MaxProtect Your AI Insurance Agent

Discover How a Smart Digital Team Translates into Efficiency, Growth, and Profitability

- Increased Quote Completion Rate:Simplifies the process and makes it accessible 24/7, capturing more prospects.

- Reduced Claims Handling Time: Streamlines information gathering and updates, improving satisfaction at critical moments.

- Automation of up to 80% of Frequently Asked Questions:Free your advisors from always answering the same thing so they can focus on complex sales.

- Improvement in Closing Rate and Cross-Selling:MaxProtect can proactively identify and suggest relevant additional coverage.

- Increased Customer Satisfaction and Retention: Offers an instant, transparent, and efficient service that generates loyalty.

- Reduction of Operational Errors: Minimizes human errors in data collection for quotes and claims.

Let's schedule a meeting soon!

Consultative Advising

WRITE TO US! Leave us your details

We answer your key questions about MaxProtect, our AI Insurance Agent

Understand in Depth How MaxProtect Can Boost Your Insurance Operation

¿Qué es un Agente IA de Seguros?

Un Agente IA de Seguros es una solución digital basada en inteligencia artificial que asiste tanto a aseguradoras como a clientes en la gestión de pólizas, cotizaciones y reclamaciones. Su objetivo es ofrecer procesos más rápidos, personalizados y seguros.

¿Qué tipos de seguros y servicios puedo gestionar a través de un agente IA?

Con un agente IA de seguros puedes gestionar seguros de vida, salud, autos, hogar y viajes, además de recibir asesoría en productos financieros. También facilita consultas, pagos y seguimiento de tus pólizas desde una sola plataforma.

¿De qué manera un agente inteligente agiliza la obtención de cotizaciones y la gestión de pólizas?

Un agente inteligente compara automáticamente diferentes opciones del mercado, genera cotizaciones en segundos y permite gestionar pólizas de forma digital, reduciendo tiempos de espera y mejorando la experiencia del usuario.

¿Puede un sistema de IA ayudarme a tramitar reclamaciones (siniestros) de forma más eficiente?

Sí, un sistema de IA en seguros agiliza el proceso de reclamaciones al validar documentos, verificar información y priorizar casos de manera automática. Esto acelera la resolución de siniestros y mejora la satisfacción del cliente.

¿Es seguro utilizar una plataforma de IA para comprar y gestionar mis pólizas?

Las plataformas de IA para seguros cuentan con protocolos de encriptación y cumplen normativas internacionales de protección de datos. Esto garantiza la seguridad y confidencialidad al comprar o gestionar pólizas en línea.

¿Cómo la inteligencia artificial ayuda a las aseguradoras a detectar y prevenir el fraude?

La IA en seguros analiza patrones de comportamiento y transacciones inusuales para detectar posibles fraudes. Gracias a sus algoritmos predictivos, ayuda a las aseguradoras a reducir riesgos y proteger tanto a la empresa como a los asegurados.

¿Qué beneficios ofrece un sistema de IA para la personalización de productos de seguros según mi perfil?

Un sistema de IA evalúa el perfil del usuario, su historial y necesidades específicas para diseñar ofertas de seguros personalizadas. Esto permite acceder a coberturas más ajustadas y a precios competitivos.

¿Un agente de IA ofrece asesoría personalizada para entender cuál es la mejor cobertura para mis necesidades?

Sí, un agente de IA en seguros puede brindar asesoría personalizada al analizar tu situación, comparar diferentes productos y recomendar la cobertura más adecuada a tus necesidades y presupuesto.

¿Cómo garantiza un agente de IA el cumplimiento normativo y la seguridad de mis datos personales?

Un agente IA de seguros cumple con las regulaciones del sector asegurador y aplica sistemas de seguridad avanzados para proteger los datos personales, asegurando transparencia y cumplimiento normativo en todo el proceso.

¿Dónde puedo contratar un agente de seguros con tecnología IA confiable?

Puedes contratar un agente de seguros con IA a través de aseguradoras que integran soluciones digitales o de plataformas especializadas en tecnología financiera. Muchas ofrecen pruebas y asesoría inicial antes de la contratación.